Enter basic filing information and facts about the taxpayer and student in the Taxpayer Information tab. This will help determine eligibility for the various education credit options and information needed for calculations in the Optimizer tab. Recent changes in the tax code now guarantees that the American Opportunity Credit is always better than the Lifetime Learning Credit, so only the best option is shown.

If the student is receiving scholarship funds or financial help from Coverdell ESA, Qualified Tuition Plans (529 Plans) or Employer-provided educational assistance, Early IRA distributions or Savings Bonds used for tuition and fees, enter the amounts in the Funding Sources tab.

If a dependent child student falls within the criteria to trigger a kiddie tax, the amount made taxable is limited to prevent that. Similarly, a dependent relative student's taxable income is limited to that which would no longer allow them to be a dependent. If the dependent has any income, enter it in the dependent's tax form in the Optimizer tab so that it will be taken into account for these limits. Note that "qualified expenses" for using a funding source tax-free may vary with the source and may also be different than the "qualified expenses" for tax credits which also differ depending on the credit type. Unrestricted scholarships can be used for living expenses if the student is willing to make those amounts taxable.

Then enter education expenses in the Expense Information tab. The columns to the right will show what expenses qualify for the American Opportunity Credit or the Lifetime Learning credit. A check-mark to the left of each expense catagory indicates that there are funds that can be used for the funding amounts in the Funding Sources tab (scholarship amounts used may be taxable). An option in the qualified expenses row, allows you to use all available funds to be spent on the qualified expenses (often results in no additional taxable income) or to use only the amount that covers expenses over that allowed for the particular credit (usually results in additional taxable income which may be offset by the use of the credit). The bottom two rows show the amounts that can be used in the taxpayer's return and the amount of unused scholarship funds that are taxable.

The Optimizer tab takes a bit more data entry and shows a detailed estimate for the best option and its effect on various other credits. To make data entry reasonable, it must be used with TaxSlayer and does not account for all factors (that would require duplicating the entire return). Randomly changing the amounts in the entered fields may result in nonsensical results in the other columns because the fields used rely on certain TaxSlayer calculations. The results are the estimated amount of change to the taxpayer's refund (or tax owed) based on the original return figures.

The optimizer prevents activating the "Kiddie Tax" due to the complexity and interactions with the parent's tax return.

Clicking the optimize button below the results modifies the amount of scholarship amount to be made taxable, seeking a better result.

Optimizer interactions with several items have not (yet) been included - some may never be. Among these are:

- Effect of taxable amount of Social Security due to change in income and its ripple effect with other items.

- Significant 1250 gain and 28% gain dividend income (doesn't account for different tax rates)

- QBI calculations for 199A dividends

- Significant tax-free interest relative to other investment income

- Education expenses deductible on Schedule C

- Effect of an IRA deduction due to change in income

- Effect of student loan interest deduction due to change in income

- Reduction of exemption amount for high income taxpayers

- Employer provided child care benefits, carryovers, prior year expenses

- Schedule R reduction of the education credit

- Effect on state tax returns

- In tax year 2022, George is a 25 year old taxpayer attending a school half time that qualifies for the American opportunity credit. He and his wife Sally have one child and earned income of $24,500 for the year.

- George has received an unrestricted grant of $4,000, used to pay for his $4,000 tuition and $500 for books.

- Without optimizing, the entire grant is used to pay for the tuition, they owe no tax and they will receive a refundable $200 for AOC, $1500 for ACTC and $3,733 earned income credit. Sounds pretty good, right?

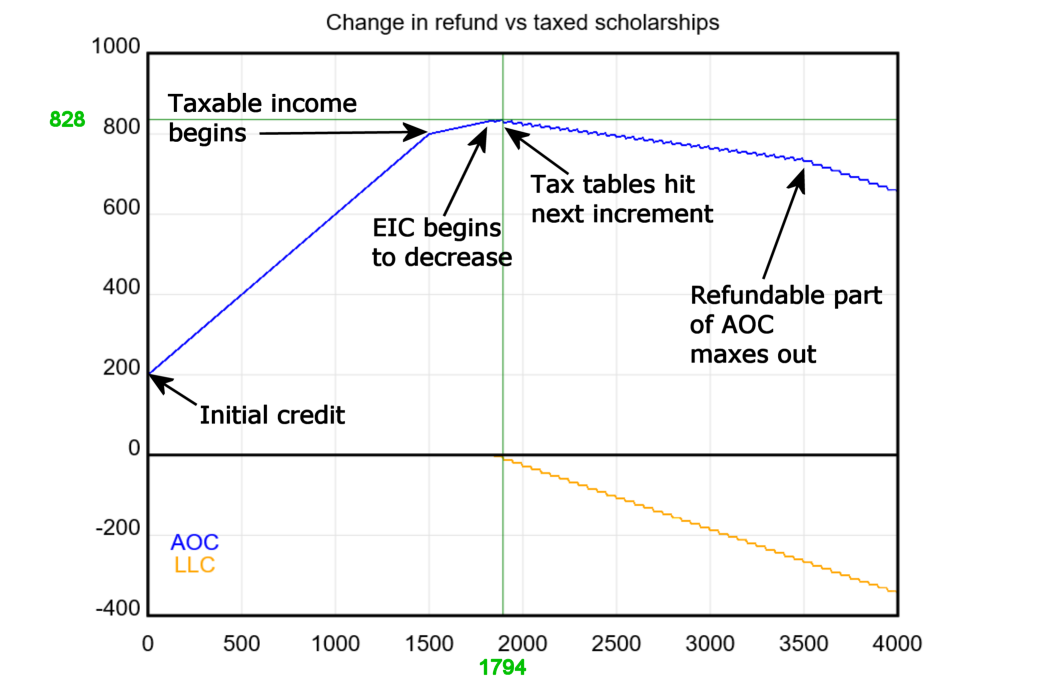

- But if you optimize, using $4,000 as room and board expenses, you will find that they will now have to pay a little tax by declaring $1,794 taxable, but will gain an additional $828 by receiving $830 in AOC and $39 education credit, which offsets the resulting tax and the decrease (-$2) in the earned income credit. To see what's happening, .

About security: Although you are entering a lot of taxpayer information in this calculator, none of that data is going to the web - it's all being calculated on your desktop, is not saved, and disappears when you exit the calculator. If you print the form, use the same care as you would if you were printing the taxpayer's actual tax return.

Please send email to webmaster@cotaxaide.org with suggestions/corrections