Tax Year 2025 is dedicated to the memory of Jeff Bogart, 1942-2025.

Welcome to the Colorado Resource Toolbox

The following tools are designed to be helpful to AARP Tax-Aide Counselors and Trainers.

They are not intended to replace official IRS documentation and while accuracy is attempted,

no software can be guaranteed to be bug-free. If you see a problem, please let us know

so that it can be corrected.

Most of the tools have a year option that allows the selection of the current and three years prior. They will default to the new tax year on December first. Version changes can be seen by viewing the web page source if desired.

Colorado tools support team

Most of the tools have a year option that allows the selection of the current and three years prior. They will default to the new tax year on December first. Version changes can be seen by viewing the web page source if desired.

Colorado tools support team

A NOTE FOR TRAINERS

There have been a few rare cases where too many accesses to the tools from the same IP address has caused that IP to be locked out as a way to detect and prevent possible hacking on the server. This has only been an issue in January when we're all in the training mode. Because we're on a shared managed server, We have no control over this.

If you have a large class (more than about 40 people) or if there are other classes elsewhere training at the same time with the same IP address (such as a large community library network), please demonstrate the tools rather than have the entire class practice at the same time and leave it as a homework exercise.

Web Accessible Tools

(AKA Pension Exclusion Calculator)

Given the taxpayer's retirement date (first retirement paycheck) and taxpayer and spouse birthdates, calculates an exclusion table by year and a sample form for TaxSlayer® input. Also handles the Public Safety Officer insurance exclusion.

Given the taxpayer's retirement date (first retirement paycheck) and taxpayer and spouse birthdates, calculates an exclusion table by year and a sample form for TaxSlayer® input. Also handles the Public Safety Officer insurance exclusion.

Rather than search through the entire list of business codes,

click on headers to expand that portion of the list until a suitable code is found.

If a taxpayer's prior year tax return has a negative amount in the capital

gains entry, there may be a carryover loss that can be used in the current year.

If the carryover worksheet is not a part of the printed return from the prior

year, this worksheet can help create it.

A Colorado-specific table that lists the city and county local sales tax

rates for use in Schedule A for those counties you select.

Is a dependent a child or relative? What benefits might the taxpayer claim as a result?

This tool is a combination of all the Pub 4012 charts - without the charts.

Choose the various taxpayer and dependent options and see a list of benefits.

If they don't qualify for a benefit, click on it to see why not.

For state tax returns, calculating and summing all the government and state exemptions

for dividends and tax-free interest in broker statements is a bit of a chore.

This worksheet assists in that task and provides a clear record of the figures

for the quality reviewer and taxpayer.

There are different ways to claim education credits,

each with their own limits and types of expenses allowed.

There are also different funding sources that can be used tax-free for different

types of expenses.

This calculator provides a way to determine which is best among the most common

two (American Opportunity Credit, Lifetime Learning Credit)

and can determine the amount of unrestricted scholarships that can be made taxable

to maximize the taxpayer's refund.

Note:

It's best to do parent and dependent student tax returns at the same time.

This tool is for the ERO who has experienced an IRS tax return submission reject due to

a mismatched EIN and payer name. The entries in this list has been accumulated from

several unverified lists and is by no means complete but may help you find the right

EIN if digits are reversed or entered incorrectly. You can enter either the name or EIN

from the incorrect tax return and indicate the number of mismatched digits for which

you wish to search. DO NOT USE THIS LIST AS A PRIMARY SOURCE FOR EINS; due to mergers,

many companies retain multiple EINs. Links to other suggested sources are also provided.

This is the Form 1040-ES form with considerable expansion,

used to estimate taxes for the next year.

This can also be used to do an MFJ/MFS comparison if there are no complications in the taxpayers' situation (such as living apart, etc)

This can also be used to do an MFJ/MFS comparison if there are no complications in the taxpayers' situation (such as living apart, etc)

This is a combination of the Head of Household Worksheet 2-1

(Cost of Keeping Up a Home) and the Pub 17 Worsheet 3-1

(Worksheet for Determining Support) — due to the similarity with

household expenses used in both worksheets.

Once in the tool, select which you want to use.

An implementation of a home sale worksheet that asks the questions needed to

determine if the taxpayer qualifies for an exclusion and assists in

calculating the basis of the home being sold. Provides input information for

the TaxSlayer® home sale worksheet and/or direct entry as a capital gain or loss

on Form 8949. Does not support partial exclusions (although indicates if the

taxpayer may qualify) and does not support homes that have been used for business

or have sustained casualty losses.

A worksheet for Form 8606 Parts I and II for Nondeductible IRA contributions.

It can handle up to 5 IRAs for each taxpayer and indicates the amount

taxable for each IRA if deductions or conversions are taken from more than one

IRA. (Form 8606 computes the total for all transactions.)

Also provides the totals for input to create the TaxSlayer® Form 8606.

MFJ/MFS Comparison

If a home mortgage includes a portion of the funds that were used

to pay expenses for other than for the home or improvements to that home,

or if the average monthly sum of all mortgages exceeds a limit,

not all the interest is deductible.

This may occur for a second or a refinanced mortgage,

especially during first few years of the mortgage.

Such other expenses might be to pay credit card debt, medical expenses,

vacation trips or a new car, as examples.

This worksheet helps determine how much of the interest paid on the mortgage

is deductible.

TaxSlayer® provides no assistance in determining the portion of

income (other than W-2s), adjustments and deductions available for

a part-year resident.

This worksheet is tailored to Colorado state tax returns

and provides TaxSlayer totals for input to the

"Income Subject to Tax" section.

Railroad retirement Tier 1 amounts are not handled correctly

by TaxSlayer® on Colorado state tax returns.

Tier 1 amount is included in the retirement exclusion

which is limited to 20K/24K and should not be

because RRB benefits are not taxable and have their own exclusion line.

This worksheet determines the amounts that should be removed

from the pension exclusion and calculates the amount that should be added

as the RRB benefits line on the State Return section of TaxSlayer.

Although designed specifically for Colorado it may work for other states

if the problem is the same.

Under Construction

Under Construction

A worksheet for totalling income items, sales tax on large item purchases,

and other nontaxable income to be used with the IRS Sales Tax Calculator.

See Pub 4012 (NTTC version), section F.

Includes many items we often don't remember to ask about.

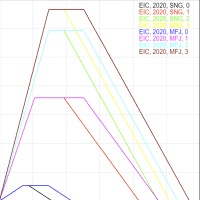

Can't find the latest version of the Earned Income Tax Credit plots?

This tool presents a graphical presentation of the amount of credit available for various

tax credits vs AGI.

For simplicity, it assumes all income is earned income and provides options for comparing

tax years, filing status and number of children (or students for education credits) or

seeing how various credits kick in for a particular year and filing status.

The effect of combinations of credits is not considered but will, of course,

change the results in a real tax return so you can't just add them together.

TaxSlayer® determines the taxable amount of the state tax refund based on sales tax and

comparison with the standard deduction.

If the taxpayer made estimated payments to the state or had negative taxable

income (may show as 0), there may be a better solution.

This calculator includes those other comparisons

so you don't have to do the math.

Taxability of other refunds, such as medical repayments, are also included

and can be quite complex when a state tax refund is also present.

Downloadable Tools for the PC (sorry, not Chromebook)

This great tool, contributed by [a tax volunteer in Washington state],

creates custom forms for training.

Create them and then save them on your PC for later use and modification.

Last updated in 2025, it produces forms for the current, prior and next calendar year.

The zip file contains two installation files - one for Tax-Aide and one for VITA/TCE.

Installation: Copy the executable in the zip file to your desktop. When you run the executable, a new directory is created with the support files and a desktop icon is (optionally) added.

Note: Some users have reported that a virus is detected on download. The author assured me that the app is clean and the virus alert is erroneous.

Installation: Copy the executable in the zip file to your desktop. When you run the executable, a new directory is created with the support files and a desktop icon is (optionally) added.

Note: Some users have reported that a virus is detected on download. The author assured me that the app is clean and the virus alert is erroneous.